It can be difficult to understand the importance of the interest rate when purchasing a 30 year loan. My thoughts: It’s significant! It’s likely that rates can rise very quickly once the economy is back on track. (update 2018: rates are rising! See the link at the bottom of the page) Here’s a quick lesson on interest rates.

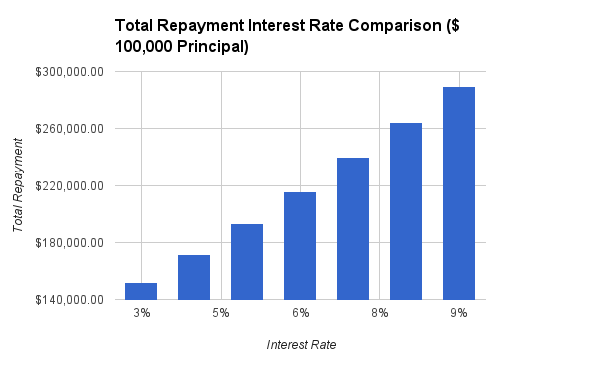

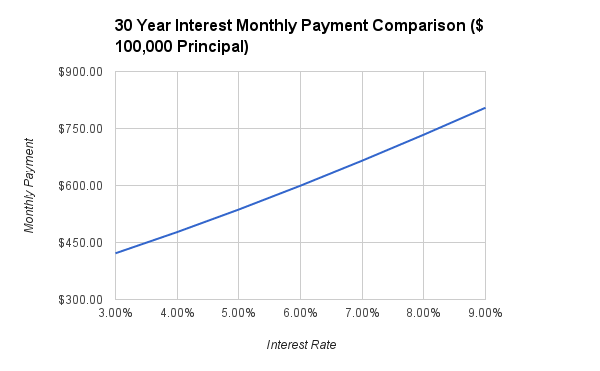

Take a look at these tables below. These show the payments and the total 30 years repayment for a $100,000 at rates from 3%-9%.

At 3% you’re only borrowing 1.5 times the amount of principal. At 9% you’re almost borrowing more than 3 times the principal!! Rates have already gone up 1/4% in the last month, 1/2% in the last quarter and are likely to keep rising.

2018 Update: Rates are going up and are expected to keep going up, so don’t miss out.

Borrowing now is like getting practically free money! Many people don’t think they have the credit or down payment for a loan these days. There are some conventional loans nowadays that only require 3% down and 580 credit score. It’s free to get a preapproval, so don’t miss out on these fantastic rates!

<a title=”Mortgage Rates and Market Data” href=”http://www.mortgagenewsdaily.com/mortgage_rates/”>Mortgage Rates and Market Data</a>

Interesting Fact: If you pay an extra payment once or more a year or add a little extra to your payments every month, you can quickly reduce the principal, reduce the amount you pay in interest, and cut your payoff time down. Also, you’ll build your equity faster and make it easier to resell quicker.

*Keep in mind the payments above are just principal and interest. They do not factor down payment, APR, closing costs, insurance or taxes.